unlevered free cash flow vs levered

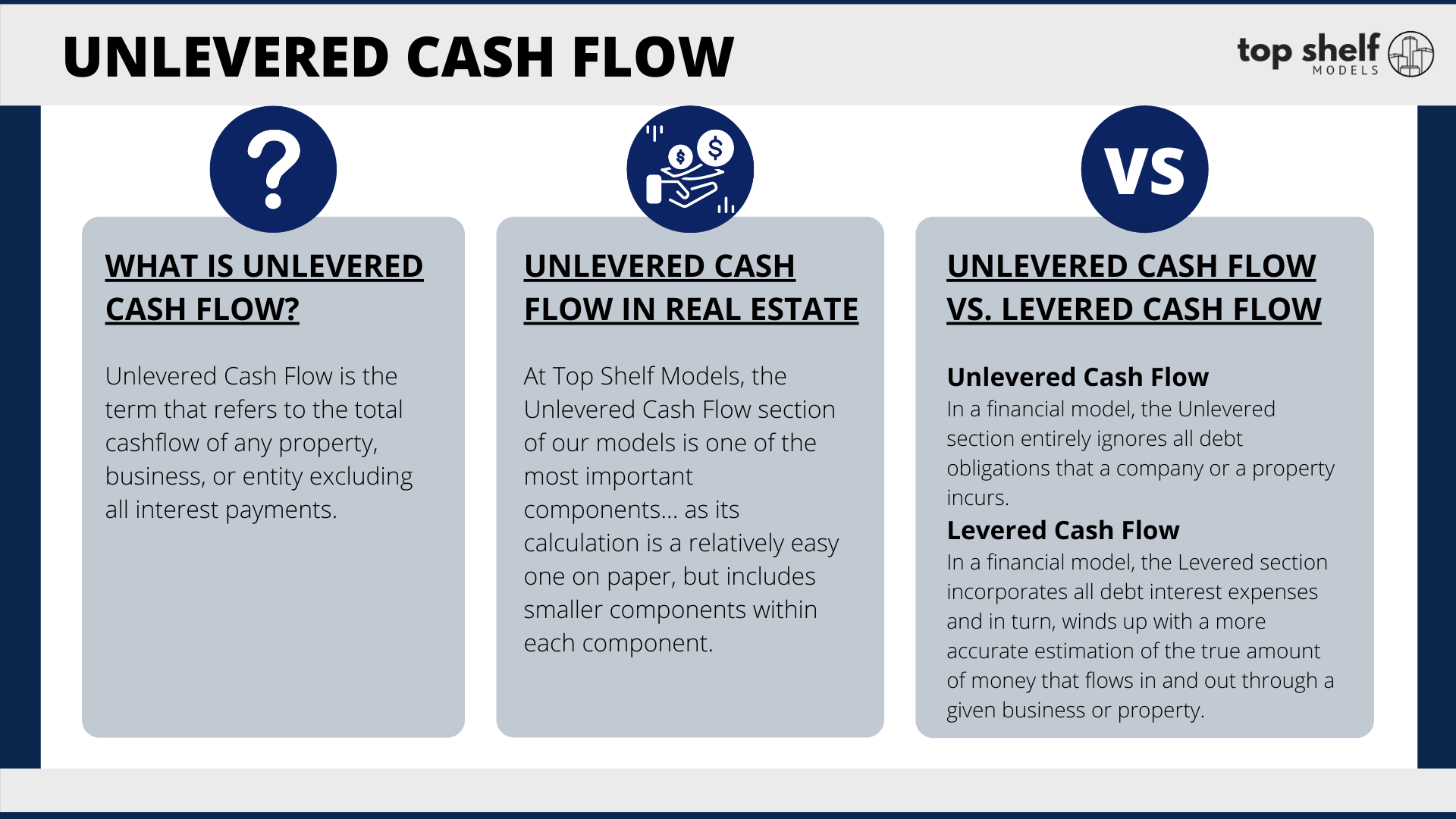

Levered free cash flow is the amount of cash a company has left remaining after paying all its financial obligations. For this scenario unlevered free cash flow is the before state and levered free cash flow is the after.

Understanding Unlevered Cash Flows In Real Estate Top Shelf Models

When evaluating potential returns for a real.

. Unlevered Free Cash Flow. These metrics are quite similar --free cash flow divided by total revenue -- but there is one. Includes interest expense but NOT debt issuances or repayments.

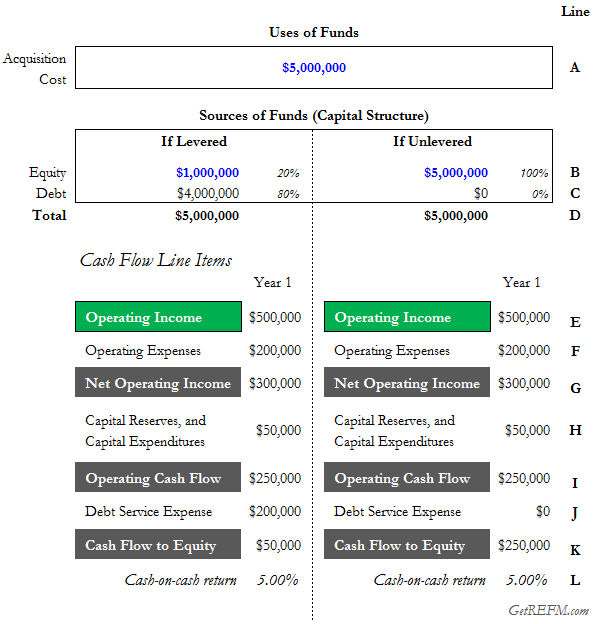

Unlevered cash flow vs. Key Learning Points. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company.

Free Cash Flow FCF is the amount of cash freely available to all capital providers. They all treat interest expense and debt repayment differently. Unlevered free cash flow is used in both DCF valuations and debt.

While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at. Levered free cash flow is different from unlevered free cash flow because the latter assumes all capital is owned and none has been.

Fundamentally the value of a commercial real estate asset is derived from the amount of cash flow that the property produces. Unlevered free cash flows indicate a companys cash flow pre-interest expense. Levered cash flows indicate a companys cash flow post-interest.

Levered free cash flow vs. Levered vs Unlevered Free Cash Flow. Think about these types of cash flow in terms of a before and after state.

If all debt-related items were removed. Levered free cash flow is important to both investors and. Unlevered and levered free cash flow margins.

Looking at the cash flow statement from their latest 10-k we can highlight the following metrics. Unlevered free cash flow. Free cash flow provides a firm an indication of the amount of money a business has left for distribution among shareholders and.

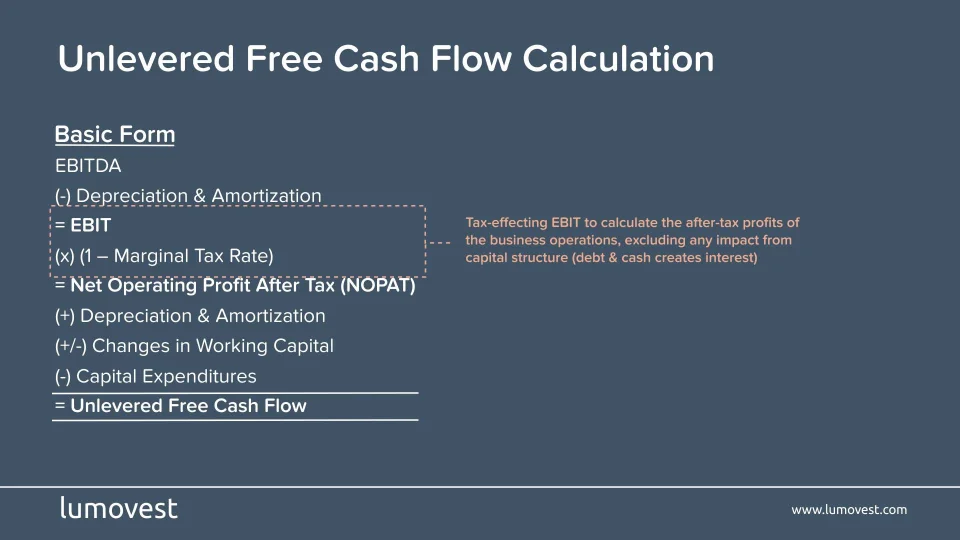

Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. This can be measured in two ways. 21 Definition of Unlevered Free Cash Flow.

Levered Free Cash Flow LFCF vs. Levered Free Cash Flow or FCFE Operating Income1-Tax Rate Amortization and Depreciation - Change in Working Capital - Capital Expenditure - Debt repayments. To calculate our levered free cash flow for 2019 wed take the following in.

Levered Free Cash Flow is considered to be an important metric from the perspective. It is the cash flow available to all equity. Free Cash Flow Margin.

The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted. Free Cash Flow margin is a ratio in which FCF is the numerator and sales is the denominator. Margin tells us what portion of sales ends up as.

Start from first principles. Unlevered Free Cash Flow aka Free Cash Flow to the Firm UFCF and FCFC for short refers to a Free Cash Flow available to all investors. Levered cash flow vs.

Free cash flow Levered cash flow is the amount of money your business has left over after paying all bills and other financial obligations including. Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors. Unlevered Free Cash Flow UFCF Levered free cash flow LFCF is the amount of money a company has after deducting the amounts payable towards.

Just like valuation multiples differ depending on the type of cash flow being used the discount rate in a DCF also differs depending on whether. Both approaches can be used to produce a valid DCF valuation. Answer 1 of 2.

Discounted Cash Flow Analysis Street Of Walls

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

What Is Free Cash Flow Calculation Formula Example

What Is Levered Free Cash Flow Definition Meaning Example

Fcf Yield Unlevered Vs Levered Formula And Calculator

Understanding Levered Vs Unlevered Free Cash Flow